We’re visiting Peter and Margaret Ellis, both in their early 70s, who live in a cozy cottage in the Cotswolds. Peter, a retired teacher, and Margaret, a former nurse, share insights into their financial journey and how they manage their retirement finances on a combined pension in their golden years.

Monthly Budget Breakdown:

- State Pension: Peter and Margaret each receive £412, totalling £824 per month.

- Private Pension: Peter and Margaret are lucky enough to have teaching and nursing pensions bringing in an additional £2,174 monthly.

- Part-Time Income: Peter does some consulting for local schools, adding around £250 per month.

Monthly Expenses:

- Council Tax: £105

- Utilities (Water, Energy): £569 (includes groceries and household essentials)

- Home Maintenance (TV License, Insurance, Boiler): £53

- Communications (Broadband, Mobile): £47

- Health (Dentist, Contact Lenses): £63

- Personal Care (Hairdresser): £21

- Transportation (Car, Public Transport): £212

- Leisure (Netflix, Dining Out, Hobbies): £61

- Charity Donations: £273

- Savings: £160

Peter and Margaret’s story starts in the bustling 70s in Liverpool, where they first met. Peter’s career as a teacher and Margaret’s as a nurse provided them with a modest but stable income. Dreaming of early retirement, they were thrifty from the start, aiming to enjoy their later years without financial worry.

The couple always aspired to retire by 65, and thanks to careful planning, they did. However, they quickly realised that living solely on the state pension would be challenging. Public sector jobs always came with a good private pension.

Their financial life hasn’t always been smooth. During a challenging period in the late 90s, they accumulated £1,000 in credit card debt—an overwhelming amount at the time, which forced them to rethink their financial strategies. They sought help from a financial adviser and learned essential budgeting and money management skills.

Since 2015, Peter has been volunteering as a financial coach, sharing his knowledge with others in similar situations. He finds this work fulfilling and builds on his years of being a teacher, especially his sessions with local community centers, where he teaches budgeting basics.

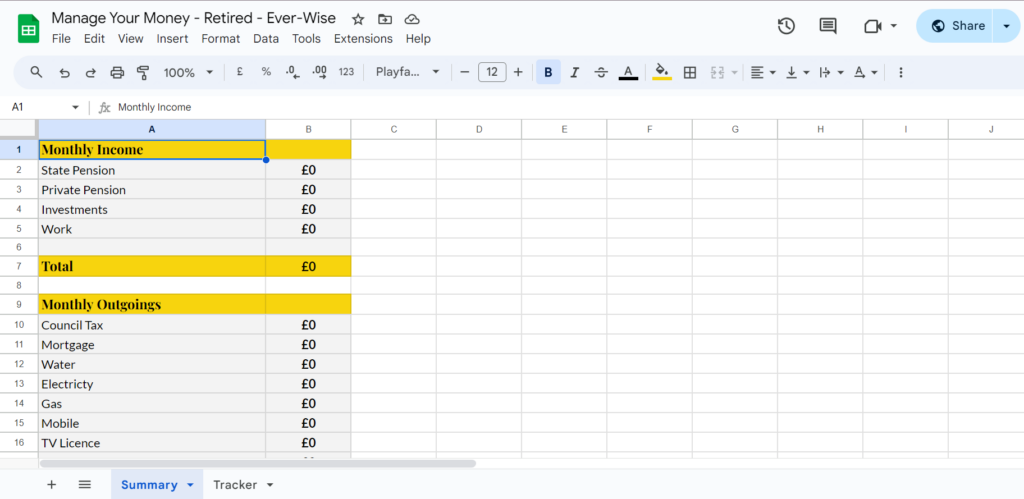

Despite their careful planning, money is still tight for the Ellis’. They use a meticulous system to manage their finances, including a budgeting spreadsheet that tracks every penny spent. They shop smart, looking for bargains and preferring store brands to save money.

For those looking to manage their finances more effectively, we’ve created a free tool they’ve found invaluable—a Google Sheet for budgeting. This is Google’s version of Excel. This tool is easy to use and can be accessed here: Google Sheets Budget Template. It provides a clear structure for tracking income and expenses, helping users stay on top of their finances with minimal hassle.

Step-by-Step Guide to Using the Google Sheets Budget Template for Managing Retirement Finances:

- Open the Link: Click on the link and open the Google Sheet

- Make a Copy: To edit the sheet, make a copy for your own use by going to File > Make a copy.

- Customise Categories: Tailor the expense and income categories to reflect your personal financial situation. You can do this by going to the “tracker” tab at the bottom of the sheet and renaming parts of the first column.

- Enter Your Data: Regularly update the sheet with your expenses and income to keep track of your financial health. The “Summary” tab creates a running average.

- Review Monthly: At the end of each month, review the totals to see where you might cut back or can afford to spend a little more.

- If you have any recommendations about how we can improve the Google Sheet please get in contact

For Peter and Margaret, managing money wisely isn’t just about securing their own future—it’s about contributing to their community and living a fulfilled life. They believe in giving back, often donating to charities and their church.

Their story is an inspiration for anyone facing retirement with financial uncertainties, demonstrating that with the right tools and a bit of knowledge, navigating these years can be done successfully and meaningfully.